Bills Receivable Format / Free Accounting Templates In Excel Smartsheet - A bill of exchange is a written or electronic order from a customer that specifies that another party, usually a bank, should pay a stated amount to the company.

Bills Receivable Format / Free Accounting Templates In Excel Smartsheet - A bill of exchange is a written or electronic order from a customer that specifies that another party, usually a bank, should pay a stated amount to the company.. Also see formula of gross margin ratio method with financial analysis, balance sheet and income statement analysis tutorials for free download on accounting4management.com. Bills receivable refers to bills drawn, the payment for which has to be received. | restaurant equipment wholesaler with a nationwide clientele accounts receivable specialist, 2014 to present maintain a/r records; For convenience of accounting, we need to classify bills of exchange into two classes: A bill of exchange and a promissory note is an example of a most commonly used bill receivable.

A bill of exchange is a written or electronic order from a customer that specifies that another party, usually a bank, should pay a stated amount to the company. The rulings for the two books are given below. The book will be totaled monthly. This topic describes the steps for setting up bills of exchange. The bill receivable document effectively replaces, for the related amount, the open debt exchanged for the bill.

Entry for endorsement of bill.

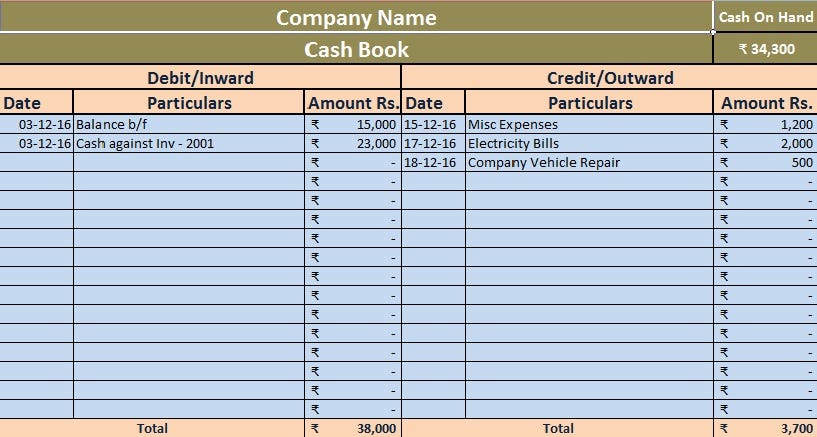

Bills receivable are often remitted for collection and used to secure short term funding. The total of the bills receivable book shows the total amount of the bills drawn and received. 2,00,000 to sales a/c cr 2,00,000 A bill receivable is sent by the debtor to the recipient to whom the amount is to be paid. What makes bill receivable template different? Sample format of the b/r book a person who draws the bill of exchange is called a drawer and a customer on whom it is drawn is called a drawee or an acceptor. A bill receivable template is drafted in formal format as per its importance in the business. The payee is the person who eventually pays for the bill. Bill of exchange can be defined as an unconditional order in writing, addressed by one person to another, signed by the person giving it, requiring the person to whom it is addressed to pay on demand or at a fixed or determinable future time a sum certain in money to or to. The book will be totaled monthly. Party from whom received date of bill due date place of payment amount lf illustration 5: Generally, in a transaction of sale and purchase of goods, during the credit term, seller of goods need money. Each workbench lets you find critical information in a flexible way, see the results in your defined format, and selectively take appropriate action.

Respond to customer inquiries regarding account status; When an individual or an organization makes a credit purchase of any goods or avails service. When a bill drawn by our creditor is accepted particulars of the same are recorded in this book. When we accept a bill drawn by a creditor it. The drawer may endorse the bill to another person who becomes the holder of the bill.

On this page, you can find a sample bill of exchange, which is drawn under a typical letter of credit transaction.

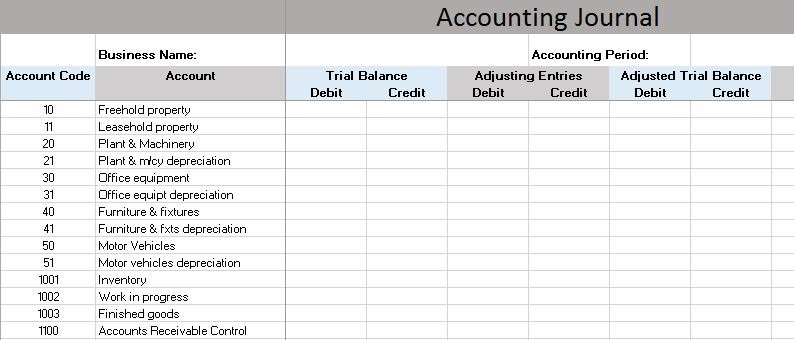

The book will be totaled monthly. A bill receivable template is drafted in formal format as per its importance in the business. The bills receivable workbench lets you create, update, remit, and manage your bills receivable. The bills drawn and received are recorded in bills receivable books and bills accepted are recorded in bills payable book. Eliminate errors w/ our fillable invoice templates. Specimen/format of bill of receivable book Date of acceptance drawer date of bill due date place of payment amount lf 26/03/2008 m/s. It is also known as bill. Bills payable (b/p) is a liability document which shows the indebtedness of an individual, an organization, etc. Needless to say, there will be an increase in accounts receivable as well as revenue for kapoor pvt ltd. Once accepted, the bill becomes bills receivable for the drawer and bills payable for the drawee or payee. The drawer may endorse the bill to another person who becomes the holder of the bill. Sample format of the b/r book a person who draws the bill of exchange is called a drawer and a customer on whom it is drawn is called a drawee or an acceptor.

The monthly total of the bills accepted is credited to the bills payable account ledger. In case of credit sales of goods, the entity may draw a bill on the buyer (debtor), for a certain period. | restaurant equipment wholesaler with a nationwide clientele accounts receivable specialist, 2014 to present maintain a/r records; A bill receivable is sent by the debtor to the recipient to whom the amount is to be paid. Eliminate errors w/ our fillable invoice templates.

Click on the button to download the desired invoice format.

Bill of exchange can be defined as an unconditional order in writing, addressed by one person to another, signed by the person giving it, requiring the person to whom it is addressed to pay on demand or at a fixed or determinable future time a sum certain in money to or to. Bills receivable is often used as an alternative term for accounts receivable but more specifically relates to amounts due to a business under bills of exchange. For the person who draws the bill of exchange and is entitled to receive its payment is known as bill receivable. Entry for renewal of bill. He should examine each bill to see that it is properly drawn, signed by the acceptor and is also. Hence, this is recorded in books of accounts as bills receivable, book debts or debtors. The monthly total of the bills accepted is credited to the bills payable account ledger. And reconcile expenses to general ledger. Particulars amount ($) particulars amount($) balance b/d (opening balance of debtors) bills receivable dishonored. (a) bills receivable or b/r: Request format all requests follow the same format and have the following components. | restaurant equipment wholesaler with a nationwide clientele accounts receivable specialist, 2014 to present maintain a/r records; Slashed average days sales outstanding (dso) from 96 to <30.

Komentar

Posting Komentar